Description

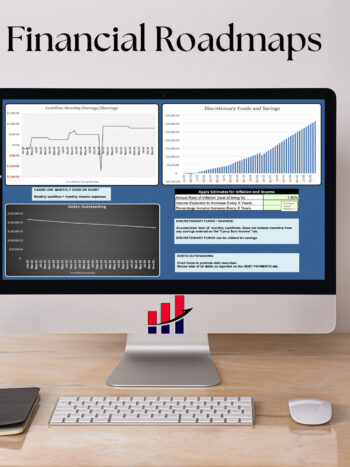

Financial Roadmap + Mortgage Acceleration Without A Heloc.

Complete Financial Planning + Optional Mortgage Accelerator Calculator for Families, Individuals, Financial Advisors & Coaches

Best For Families

Accelerate any mortgage with periodic extra payments. Benefits: mortgage is paid off sooner, reduce risk of debt due to loss of income, increase retirement savings. This roadmap is ideal for most homeowners. No Heloc is required.

30-Year Financial Roadmap

A 30-year financial forecasting roadmap includes the optional no-heloc mortgage accelerator tool. Includes budgeting, cash flow management, debt reduction, and retirement planning too.

Adjust For Inflation

Inflation will have a significant impact on the ability to meet future financial goals. This roadmap offers homeowners a means to incorporate various inflation estimates and their effects on future finances.

This 30-year roadmap covers all key areas of financial planning. Homeowners can see how its optional mortgage acceleration feature supercharges long-term financial security. This roadmap’s sophisticated financial calculations offers homeowners the power to maximize long-term financial goals and retirement savings. It also includes budgeting, savings, investments, debt reduction, and retirement planning features. It is designed to be user-friendly, with intuitive navigation and clear, concise instructions that make financial forecasting the most reliable way to maximize long-term financial outcomes.

Extra Payments Report

Assign extra mortgage payments when entering expenses and they are shown in this report as projected dates and amounts. accelerator section of the roadmap updates all tabs to reflect the payments. No other mortgage accelerator has the level of detail in our mortgage accelerator roadmap. This roadmap is the only financial planning system you’ll ever need to save on your mortgage and meet every financial goal.

Month-By-Month Cashflow Analysis

This Financial Plan Roadmap covers all the key areas of financial planning: cash flow management & analysis, budgeting, savings, investments, debt reduction, retirement planning, and more.

Interactive charts and graphs

The roadmap’s numerical data is augmented with clear and easy-to-understand charts and graphs that help visualize your financial plan and track progress.

Overage/Shortage Spending Forecast

A monthly cash flow forecast report gives advanced notice of negative cashflow, alerting users in advance of the need to plan to cover these expenses.

Cumulative Discretionary Funds Forecast

Funds that have not been allocated to any expense or to savings may indicate potential “leaks” in the monthly budget. These are funds that may be overlooked as unrealized incidental expenses that, over time, can be significant. This roadmap provides critical information to take action to plug financial “leaks”.

Outstanding Debts Forecast

Manage and reduce debts using one of the recommended debt reduction strategies the roadmap provides on the on-page instructions. The outstanding debts forecast shows the total balance of all debts each month and incentivizes user attention to this important aspect of financial planning.

Reviews

There are no reviews yet.